Client Need

DLA faced challenges in assessing the financial and operational stability of its vast supplier network, making it difficult to predict potential failures or disruptions. They wanted to identify small businesses, new market entrants, and innovation-driven suppliers to ensure a resilient and diversified supplier ecosystem.

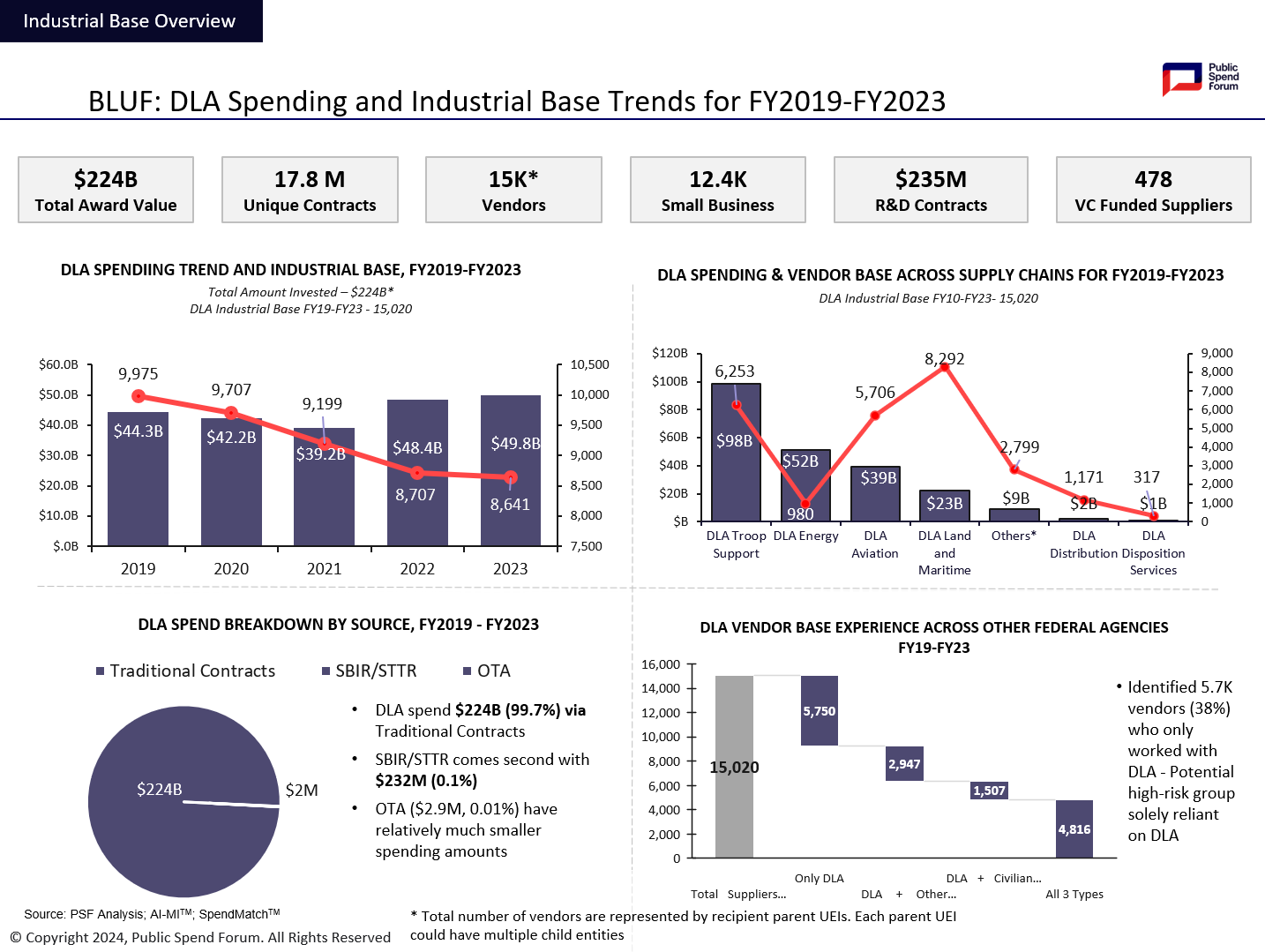

Analyzed the DLA spending and industrial base trends across 15K vendors from FY2019 to FY2023. 99.7% of the total $224B spending is made via traditional contracts.

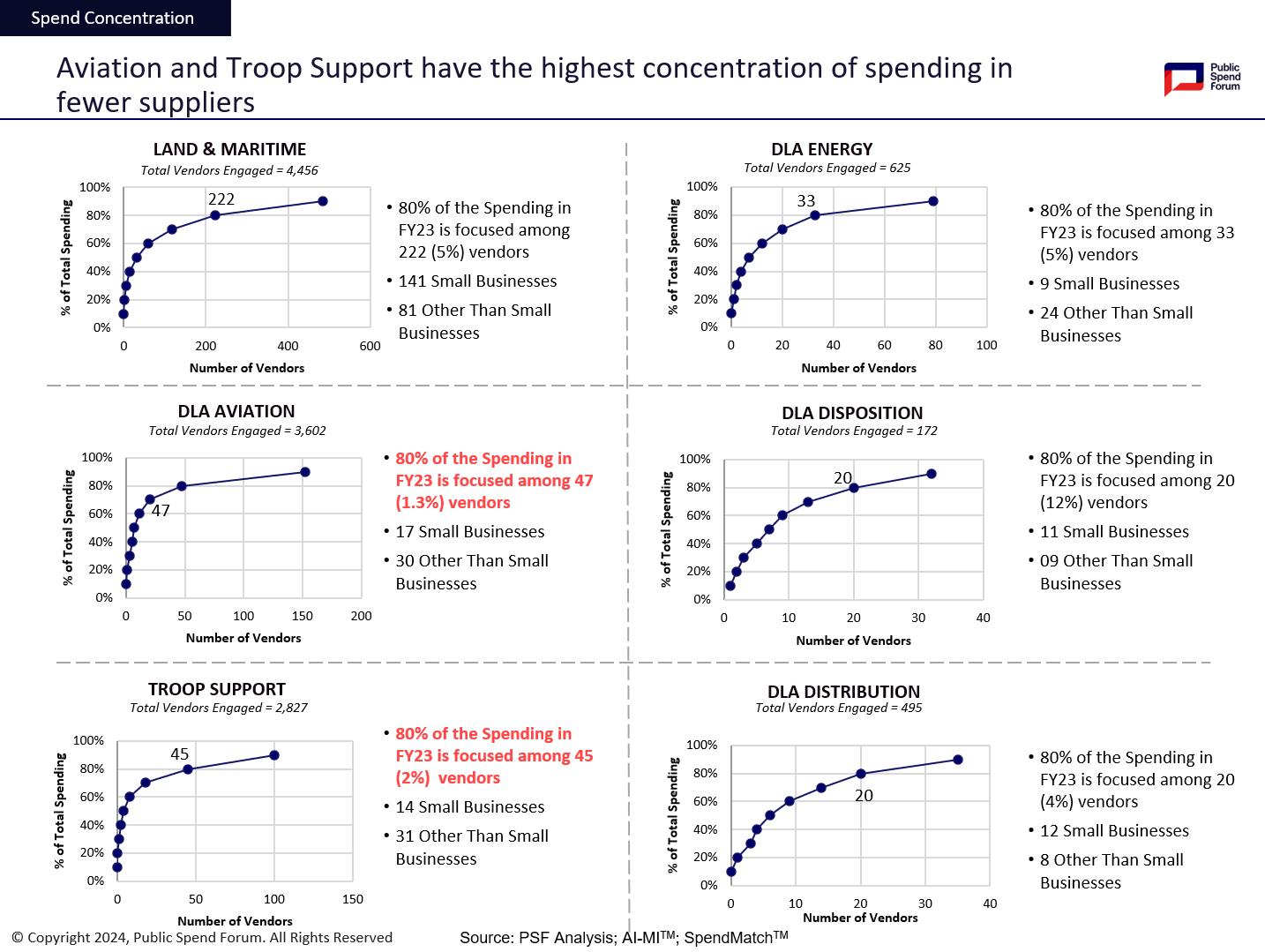

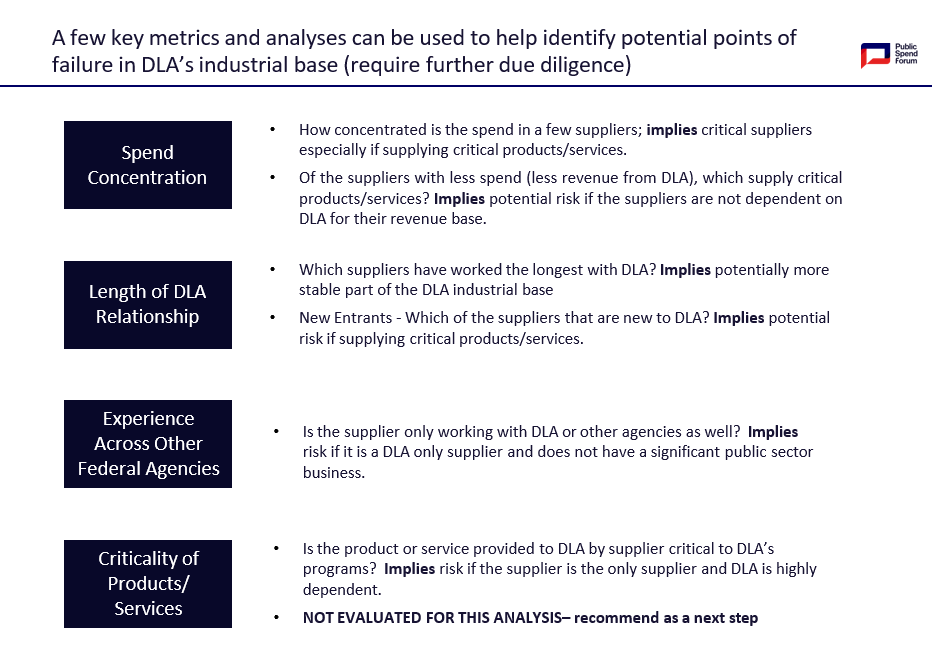

Analyzed the spending patterns of DLA’s supply chains for FY2019 to FY2023, to perform the concentration analysis, where Aviation and Troop Support had the highest concentration of spending in fewer suppliers.

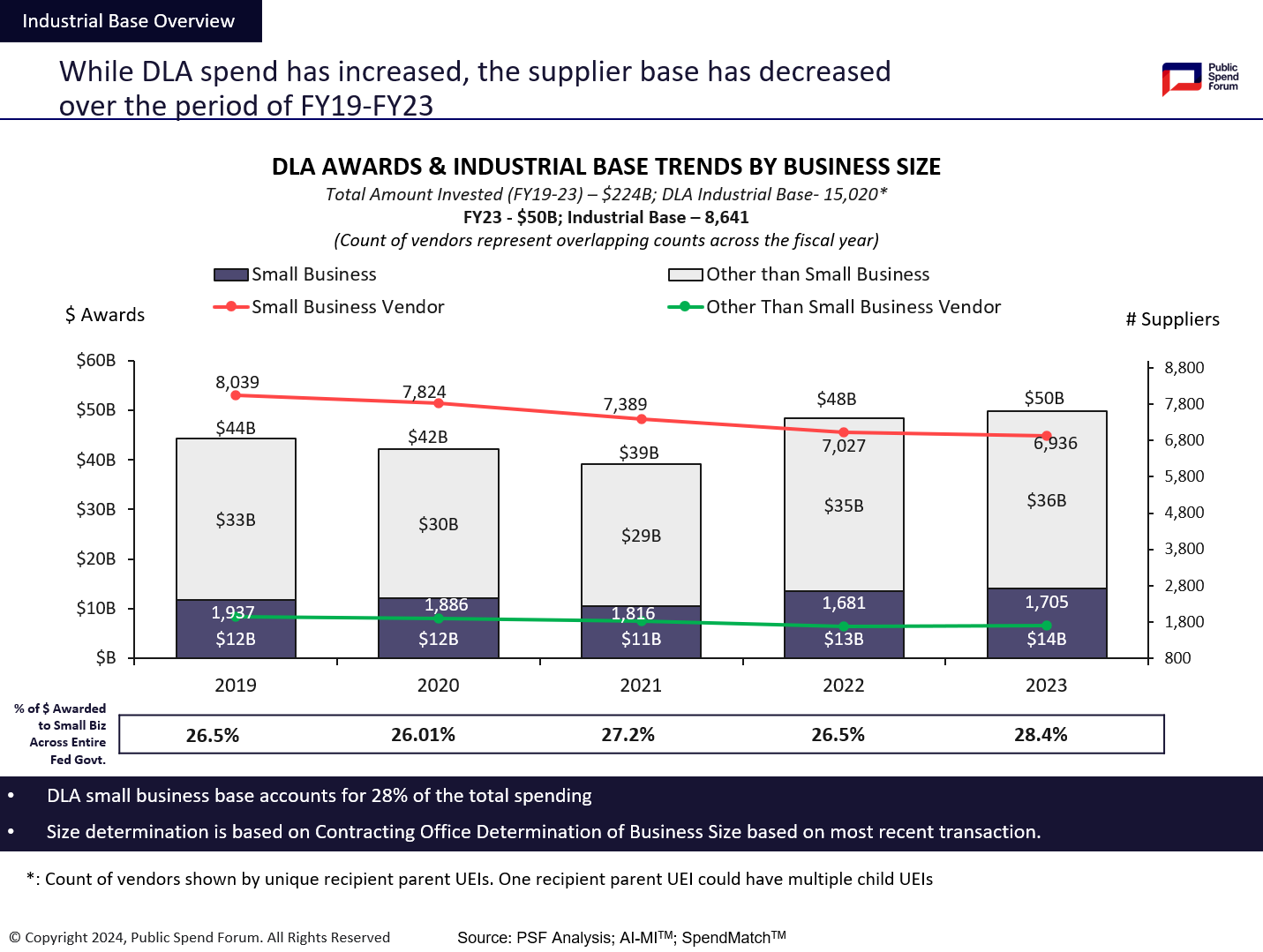

While DLA spending has increased, the supplier base has decreased throughout FY2019 – FY2023. DLA’s small business base accounts for 28% of the total spending

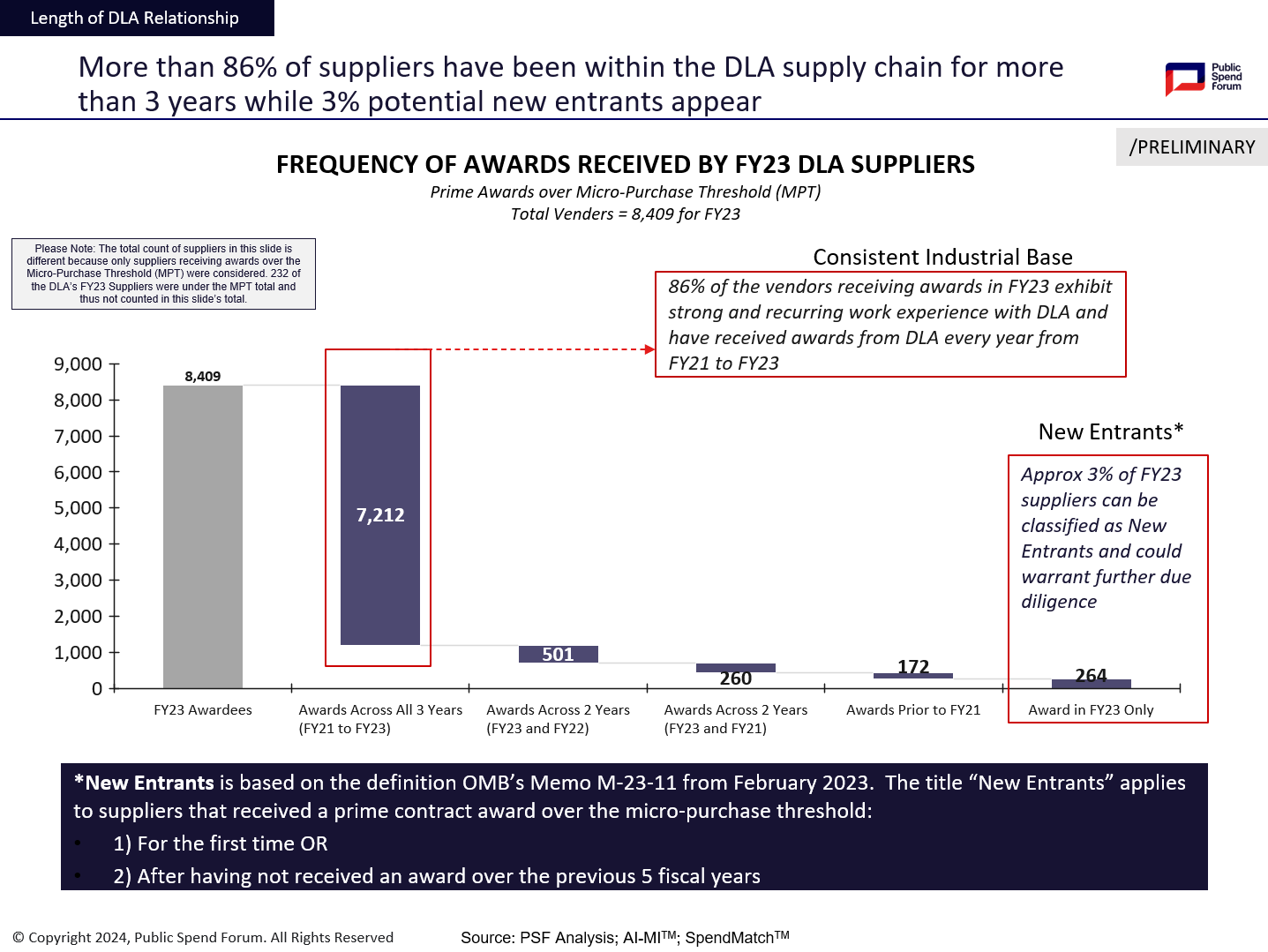

We analyzed the length of DLA’s relationships, and more than 86% of suppliers have been within the DLA supply chain for more than 3 years, while 3% potential new entrants appear.

- Utilized enriched datasets, AI algorithms, and an analyst-led rapid sprint process to assess DLA's spending from fiscal year 2019 to 2023.

- Provided visibility into DLA’s industrial base assessment, identifying key suppliers critical to supply chains.

- Pinpointed supplier pools requiring further due diligence to assess potential points of failure.

How can we help you?

We're ready to help you discover the right companies and ecosystem partners, understand technology/market trends and track risk/commercialization potential of your portfolio of companies/contractors.